Mobile robots have experienced substantial growth in the last decade due to their autonomous mobility, which has been propelled by advancements in robotics technology, autonomous navigation, and artificial intelligence. IDTechEx's market research report, titled “Mobile Robotics in Logistics, Warehousing, and Delivery 2024-2044”, delves into the technical, regulatory, and market aspects influencing the emerging logistics mobile robot industry.

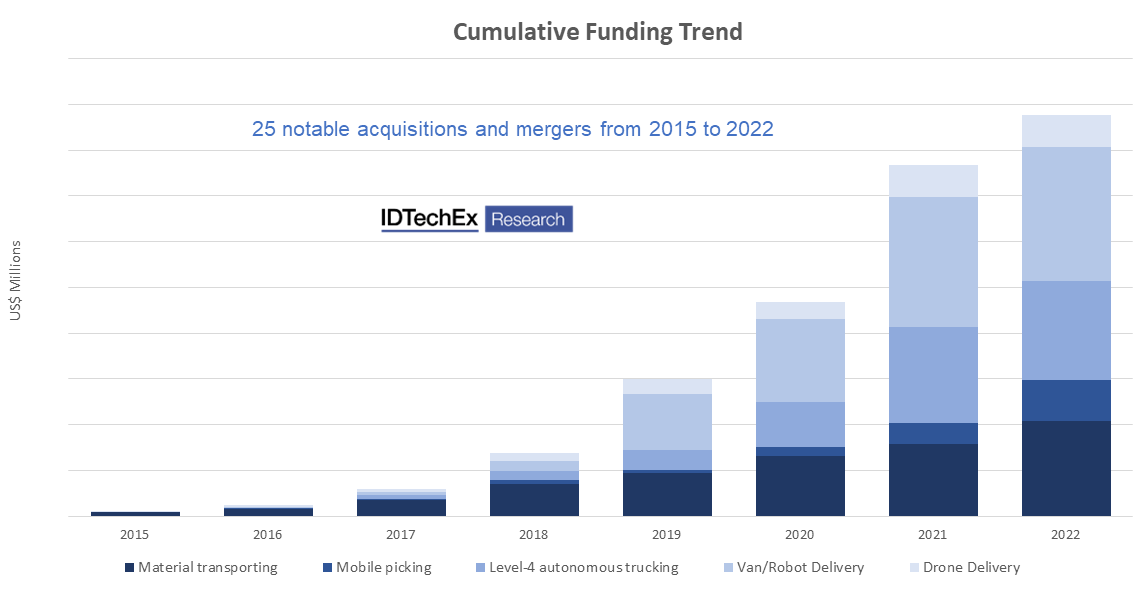

Trend of cumulative funding from 2015 to 2022. Image Credit: IDTechEx – “Mobile Robotics in Logistics, Warehousing and Delivery 2024-2044”

Trend of cumulative funding from 2015 to 2022. Image Credit: IDTechEx – “Mobile Robotics in Logistics, Warehousing and Delivery 2024-2044”

According to IDTechEx’s research, there has been a significant cumulative increase in funding for various types of mobile robots (e.g., mobile picking, intralogistics, material handling, etc.) from 2015 to 2022. This trend highlights the potential of mobile robots to automate various logistics operations, including material handling, material picking, long-haul distribution, and last-mile delivery. As of 2023, some applications, such as material transport using automated guided vehicles (AGVs), have already reached a mature stage, attracting billions of dollars in annual revenue. However, other applications, like drone delivery, are still emerging and are not expected to see widespread deployment until the end of this decade due to regulatory constraints and specific technological challenges.

Despite varying market readiness levels, each segment is experiencing rapid growth, with instances of technology giants acquiring start-up companies. Some noteworthy recent examples include the acquisition of Robotnik by United Robotics Group, Amazon's acquisition of iRobot, and the merger of Mobile Industrial Robots (MiR, a Teradyne company) with AutoGuide Mobile Robots.

IDTechEx’s report, “Mobile Robotics in Logistics, Warehousing and Delivery 2024-2044”, examines the key products used in various logistics operations, including AGVs (e.g., tow tractors, forklift AGVs, unit load carts, ‘goods to person’ grid based AGVs, etc.), autonomous mobile robots (AMRs), case-picking robots, mobile manipulators, heavy load autonomous mobile vehicles (AMVs), and last-mile delivery robots (vans, sidewalk robots, and drones). The report highlighted recent technology advancements and commercial transitions, such as how Amazon’s first fully autonomous mobile robot, Proteus, is expected to drive the adoption of AMRs in warehouses.

In terms of the technology, IDTechEx analyzed the teardown components of various mobile robots to offer an in-depth technology analysis of emerging technologies underpinning the growth of mobile robots. These technologies range from sensors such as LiDAR, ultrasonic sensors, and cameras to software such as computer vision, simultaneous localization and mapping (SLAM), and other navigation and sensing technologies. IDTechEx interviewed a number of industry players ranging from leading companies such as Omron, MiR, and ForwardX Robotics to mid-sized companies and start-ups to discuss the unique value propositions of their technologies, how they can help to address the pain points, along with the most updated business information such as regulatory approvals, funding status, and latest flagship products.

One of the transitions IDTechEx spotted is the transition from AGVs to AMRs. AGVs have been widely adopted in many warehouses. Unlike AMRs, AGVs rely on infrastructures such as magnetic tapes, QR codes, and markers to navigate. Although this provides high navigation accuracy, it increases the total cost of setting up the infrastructure and restricts the flexibility of AGVs. With the emerging SLAM technology and more companies demanding flexible operation, IDTechEx has noticed a few AMRs being used in factories and warehouses, for example, Amazon’s Proteus. The IDTechEx report analyzes both AGVs and AMRs and provides an independent analysis of what scenarios these two robot types would be favorable to users.

The report also provides 20-year market forecasts for the future of mobile robotics in the logistics industry, including granular breakdowns by application area and product categories. Through IDTechEx’s research, the yearly market size of mobile robots (L4 trucks exclusive) will reach around US$150 billion, representing significant opportunities for component suppliers, robot OEMs, and end-users.